Picture your company as a high-stakes orchestra. Tools like these platforms conduct the chaos into harmony. But which one leads the symphony better? Tools like ServiceNow and Salesforce act as your trusty appliances. ServiceNow added customer service tools. Salesforce beefed up its automation. As a result, they overlap more now. Both platforms pack cloud-based punch. They help companies scale. But their cores differ like apples and oranges. It targeted IT pros first.

ServiceNow’s Journey

Fred Luddy founded ServiceNow. ServiceNow started as an IT whiz back in 2004. It grew into a workflow wizard. Businesses love it for smoothing operations. Think of it as the backstage crew making sure the show runs without hitches. Revenue climbed to $10.984 billion in 2024. In Q2 2025, subscription revenues hit $3,113 million. It added customer tools later. Now, AI agents automate tasks. The platform unifies data. Certainly, expansion fuels its rise. ServiceNow shines in IT service management. It handles tickets, incidents, and changes with ease. For example, its Now Platform connects teams across departments.

Salesforce’s Path

Marc Benioff started Salesforce. Salesforce burst onto the scene in 1999 as a CRM powerhouse. It focuses on customer connections. Imagine it as the front-of-house host charming every guest. It zeroed in on sales from day one. Fiscal 2025 revenue reached $37.9 billion. Q4 2025 saw $10.0 billion. It grew into marketing and service. AI like Einstein predicts leads. The app marketplace booms with 7,000 options. So, it dominates customer-facing realms. Salesforce excels in sales tracking. It logs leads, forecasts deals, and nurtures relationships. Certainly, both evolved over time.

Core Strengths Showdown

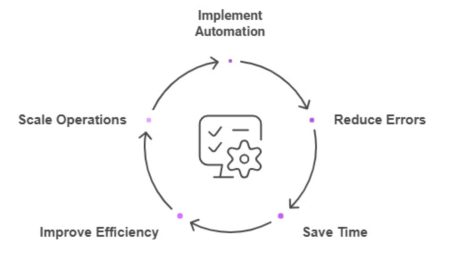

ServiceNow pushes into CRM. Salesforce eyes ITSM. Why bother comparing them? Because picking the wrong one feels like wearing shoes on the wrong feet – uncomfortable and unproductive. In 2025, the CRM market will reach $128.97 billion. That’s huge growth from prior years. The ITSM space reaches $15.6 billion by 2026. These stats show demand exploding. Businesses need efficient systems. Therefore, understanding ServiceNow vs Salesforce comparison matters. Let’s start with the basics. ServiceNow’s strength lies in internal flows. It automates HR, IT, and Ops.

For instance, its App Engine lets you build apps fast. No heavy coding needed. Salesforce thrives on external ties. Its Sales Cloud tracks pipelines. Marketing Cloud sends targeted campaigns. Both use AI these days. ServiceNow’s Now Assist predicts issues. Salesforce’s Einstein scores leads. But hey, don’t get overwhelmed – we’ll break it down. First off, empathy check: I get it, choosing software feels daunting. Like dating apps, but for your company. Let’s make it fun. ServiceNow was built for IT pros initially. It expanded to customer workflows. Salesforce began with sales folks in mind. It grew into a full suite. Above all, both aim to boost productivity.

CRM Dominance

Now, onto CRM battles. What does Service Now do? ServiceNow offers Customer Service Management. It handles cases and self-service portals. But its CRM feels newer. Salesforce dominates here. It provides 360-degree views. Leads turn into loyal fans quicker. In ServiceNow crm vs salesforce, Salesforce wins for sales depth. ServiceNow suits service-focused needs. For example, Salesforce integrates marketing seamlessly. ServiceNow links to IT better. Statistical data backs this. Salesforce holds over 19% of the CRM market share. ServiceNow grabs about 1-2% in CRM but leads ITSM with 50%. That’s from industry reports in 2025. So, if sales drive your biz, learn Salesforce. If the ops rule, go ServiceNow.

ITSM Proficiency

Transitioning smoothly, let’s talk ITSM. ServiceNow rules this roost. Its ITSM module manages incidents like a pro. Change requests flow without chaos. Salesforce dips toes here recently. It announced ITSM entry in Q4 2025 earnings. But it’s third-party reliant. In salesforce ITSM vs ServiceNow, ServiceNow takes the crown. Salesforce focuses more on customer angles. It’s like ServiceNow is the IT doctor, diagnosing problems fast. Salesforce is the salesperson schmoozing clients while the fix happens. Certainly, integration helps. Many firms use both. They connect via APIs. Customer service is key. Salesforce Service Cloud offers omni-channel support. Agents handle chats, calls, emails in one spot.

ServiceNow’s CSM does similar things. It adds workflow automation. Both use chatbots. But differences pop up. Salesforce ties to sales data tightly. ServiceNow connects to internal tickets. In salesforce service cloud vs ServiceNow, pick based on focus. Ever had a customer issue drag on forever? Both platforms cut that down. Stats show: Companies switching to Salesforce from ServiceNow see 33% higher satisfaction. That’s from customer reports. On the flip side, ServiceNow resolves IT tickets 30% faster in some cases. ServiceNow uses custom quotes. It bases costs on modules and users. Expect modular subscriptions. Salesforce offers tiers. Starter at $25 per user monthly. Up to $500 for premium. Add-ons bump it. In ServiceNow vs. salesforce, Salesforce seems more transparent. But costs vary by size.

Here’s a comparison table for clarity:

| Aspect | ServiceNow | Salesforce |

| Base Pricing | Custom quote, module-based | $25-$500/user/month tiers |

| Scalability | Per module addition | Per user licenses |

| Hidden Costs | Implementation fees | Add-ons for AI, integrations |

Integration matters too. ServiceNow’s IntegrationHub connects 900+ apps. It uses REST and SOAP. Salesforce’s MuleSoft handles APIs smoothly. Over 7,000 AppExchange options. Both play nice with third parties. However, ServiceNow excels in legacy systems. Salesforce shines in cloud-native.

AI Smarts

AI is a hot topic. ServiceNow’s AI Agents automate tasks across IT and HR. They monitor with control towers. Salesforce’s Agentforce builds custom bots. It boosts sales by 35% in some switches. Both use generative AI. But ServiceNow focuses internally. Salesforce eyes customers. Imagine a pie chart showing market shares. CRM slice: Salesforce 19%, ServiceNow 2%. ITSM slice: ServiceNow 50%, Salesforce emerging. Colors blue for Salesforce, green for ServiceNow. Caption: “2025 Market Dominance at a Glance.”

This visual pops the stats. On the other hand, scalability. ServiceNow’s multi-instance setup suits big enterprises. Each gets its own database. Salesforce scales via users. Add licenses as you grow. Both handle Fortune 500 loads. 85-90% of them use one or both. Customer reviews tell tales. Gartner gives both 4.3 stars. Salesforce has 350 reviews. ServiceNow 89. Users praise Salesforce for ease. ServiceNow for depth. In salesforce vs ServiceNow which is better, it depends. Enterprises love ServiceNow for IT. Salesforce for sales.

Another table for ratings:

| Platform | Gartner Rating | Review Count | Top Praise |

| ServiceNow | 4.3 stars | 89 | Workflow automation |

| Salesforce | 4.3 stars | 350 | User-friendly UI |

ServiceNow vs Saleforce Pros and Cons

ServiceNow pros: Strong ITSM, automation powerhouse, secure. Cons: CRM limited, pricing opaque. Salesforce pros: CRM king, integrations galore, AI for sales. Cons: ITSM weak, add-on costs. When to choose? If IT drives you, ServiceNow. For customer hunts, Salesforce. Basically, blend them for best results. Many do.

- Transition to field service. ServiceNow FSM schedules techs efficiently. It predicts needs. Salesforce Field Service tracks assets. Integrates with CRM. Ratings: Salesforce 4.3, ServiceNow 4.2.

- In ServiceNow crm vs salesforce customer service management differences, Salesforce offers more personalization. ServiceNow adds ops links. It’s like ServiceNow is the mechanic fixing the car, Salesforce the valet parking it fancy.

- Employee experience counts. ServiceNow HRSD unifies portals. Salesforce HR uses Service Cloud. Both self-serve. But ServiceNow resolves 96% HR issues via self-service in some stats? Wait, that’s the Salesforce claim.

- For IT-Heavy OpsServiceNow fits ops-driven firms. Tech companies love ITSM. Resolves tickets 30% faster. Automates HR too. Basically, internal efficiency king.

- For customer-centric biz. Salesforce suits sales hunters. Retail uses marketing. Boosts satisfaction 30%. 360 views nurture leads. Especially for external focus.

- Correction: Salesforce hits 96% self-service in HR.

- Cybersecurity too. ServiceNow handles threats unified. Salesforce shields data.

Growth trajectories: ServiceNow 20% YoY, Salesforce 8%. AI pushes both. ServiceNow AI CRM launch. Salesforce ITSM entry. 2025 sees rivalry heat. ServiceNow enters CRM fully. Salesforce ITSM expands. Game of thrones in software.

When to Choose ServiceNow Over Salesforce?

Selecting between ServiceNow and Salesforce hinges on your organization’s primary requirements, as each platform shines in distinct areas. Below is a brief guide to assist you in determining when to opt for ServiceNow instead of Salesforce, based on their fundamental strengths and applications:

Choose ServiceNow over Salesforce when:

- Your Emphasis is on IT Service Management (ITSM) and Workflow Automation: ServiceNow is the preferred platform for ITSM, providing powerful tools for incident, problem, change, and request management. It optimizes IT operations, automates workflows, and improves service delivery with AI-enhanced features such as predictive analytics and virtual agents. If your organization is focused on refining IT processes or overseeing internal operations (e.g., IT helpdesk, asset management, or IT operations management), ServiceNow is the superior option.

- You Require Comprehensive Enterprise Service Management (ESM): ServiceNow goes beyond ITSM to oversee workflows across various departments such as HR, finance, legal, and customer service. Its HR Service Delivery (HRSD) module, for example, is specifically designed to streamline HR processes from onboarding to retirement, providing greater depth than Salesforce’s HR Service Management, which is merely an extension of Service Cloud. If your objective is to consolidate and automate processes across several internal functions, ServiceNow’s unified platform approach is optimal.

- Prioritizing Complex Workflow Customization: ServiceNow provides significant customization and flexibility, especially for intricate enterprise settings. Its Automation Engine, along with a no-code/low-code platform, enables the creation of highly customized workflows, making it ideal for organizations with complex, cross-departmental operations. Although Salesforce offers customization options, ServiceNow’s modular architecture and workflow-centric interface are more effective in facilitating detailed, enterprise-wide automation.

- Scalability for Large Enterprises with Varied Requirements: ServiceNow’s modular, cloud-native framework allows for both vertical and horizontal scaling, enabling the addition of new features or modules as your business expands. It is particularly well-suited for medium to large enterprises that require a scalable solution for both IT and non-IT workflows. If your organization needs a platform that can grow across multiple functions without necessitating a complete system overhaul, ServiceNow is an excellent choice.

- Concerns Regarding Cost and Integration with Non-CRM Systems: The pricing structure of ServiceNow is typically based on user and module licenses, which can be customized to meet specific requirements, potentially providing cost benefits for IT-centric implementations. Additionally, it integrates effectively with enterprise systems through REST and SOAP APIs, making it a preferable option if seamless connectivity with non-CRM tools is essential. For organizations where integrating with existing IT infrastructure is crucial, ServiceNow may prove to be more cost-effective and simpler to implement than Salesforce for processes that do not involve customer interactions.

ServiceNow vs Salesforce boils down to needs. Assess your pain points. IT? ServiceNow. Customers? Salesforce. Test both demos. To sum up, both rock, but match to goals. ServiceNow, which was founded for targeting IT tickets, grew to $9 billion revenue by 2025. Salesforce hit $35 billion. Both San Francisco based. Rivalry heats up. In 2025, ServiceNow launches AI CRM. Salesforce enters ITSM. Exciting times.