Digital Bank Case Study

GeeksForLess was chosen as a strategic technology partner to design and implement the digital-first bank. Our team was responsible for the whole architecture design, technology piece of the RFPs, product teams Managment, Quality Assurance, Penetration testing, participating in ISO/SOC certification, features design and product enhancements, infrastructure administration.

Legacy architecture of commercial banks has fundamental disadvantages that do not allow organizations to manage their clients effectively or respond to changing business environments (product/service development and regulatory changes) in a timely and cost-effective manner. This negative customer service experience and the lack of technology advancements adversely impacts customer loyalty. GeeksForLess helped it’s client to resolve current technology challenges and issues.

“Digital-First” Bank implementation

WE RECEIVED:

And idea from the client to build a “Digital-First” Bank in the Caribbe- an/Central American Region with a Scalable Hub & Spoke Model that provides a Substantial Competitive Advantage in Customer Product Suite, Customer Service and Cost of Delivery.

WHAT WE HAVE ACHIEVED DURING FIRST PHASE:

Developed technology architecture of the “Digital-First” Bank with the next governing principles:

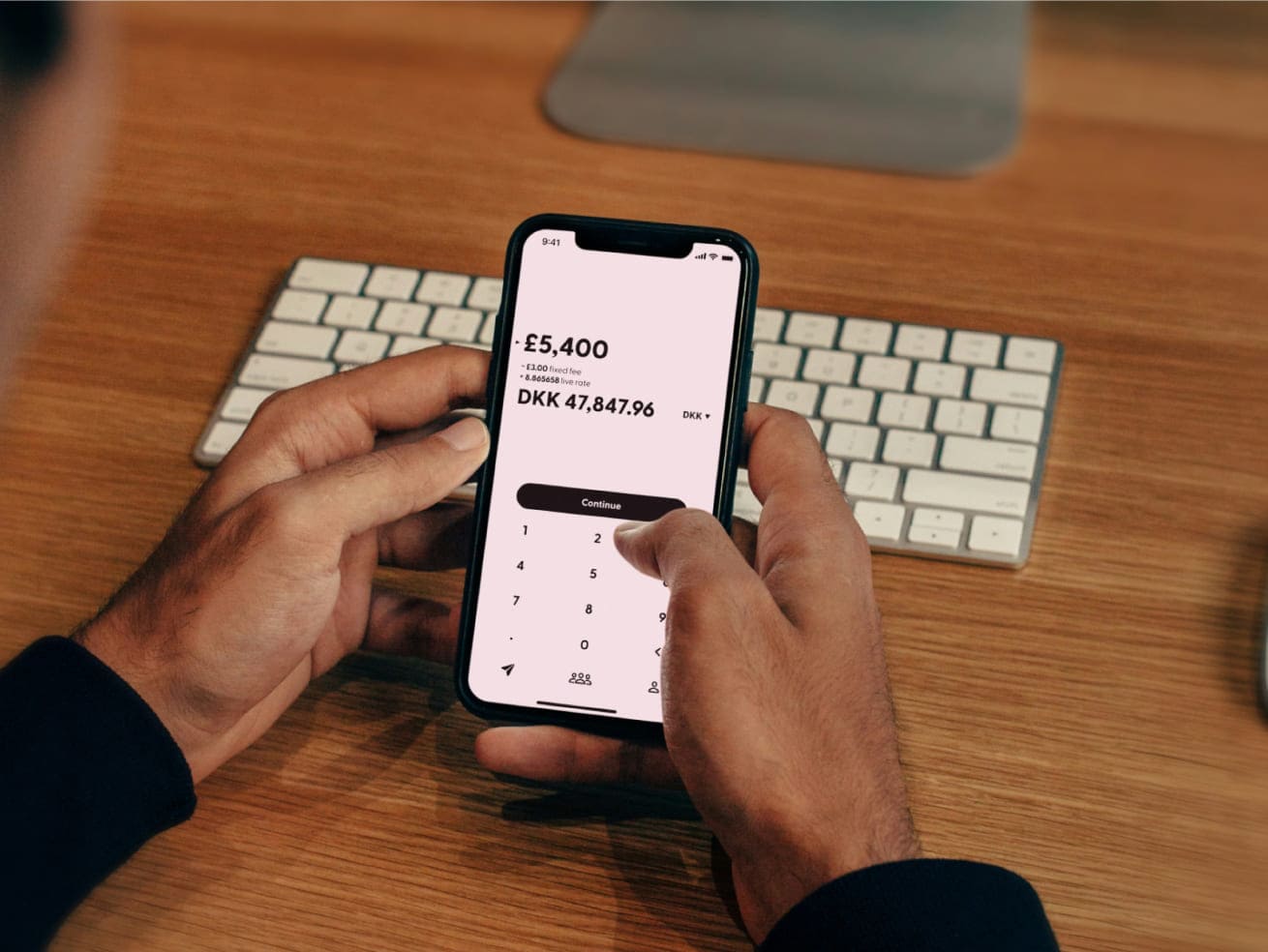

- Customer Centric Design – a focus on user experiences

- “Digital-First” Design – built for the devices that consumers use

- Scalability & Portability – Future-proofing the offering

- Safety & Security – Must have priorities in all banking products

- Modular (“Plug & Play”) Architecture – Providing nimbleness to add features and secure long-term Cost-Effectiveness

Daily calls setup with progress updates.

Performed vendor engagement (meetings, detailed product reviews, product demos, etc.) Identified a wide range of potential vendors and narrow the list down to a fit-for-purpose group for deeper engagement along six major technology segments.

Prepared and executed RFP for the technology part.

WHAT WE DID NEXT:

- Created a complete test plan and executed it

- Designed new features and introduced product enhancements

- Designed digital onboarding of the bank clients from scratch

- Developed and implemented Security Policies, System hardening, Monitoring

- Coordinated vendors in six technology segments of the “Digital-First” Bank

- Developed Bank orchestration layer to connect digital components with the Core

- Performed Database administration, Web server administration

- Build 360 customer degree module using Big Data and ML (Machine Learning) technology.

- Done Penetration testing

- GeeksForLess Security team was involved in ISO/SOC certification

AS A RESULT, WE ACHIEVED THE FOLLOWING:

- Successfully lunched the Bank in the first target country

- Supported Bank to meet compliance and regulatory requirements via technology

- Improved overall product quality

- Enhanced the customer experience

- Facilitated cardless transactions (first in the region)

- Provided Bank with powerful monitoring services